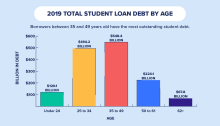

With rising costs of education, the burden of student loan debt affects ability to purchase essentials like housing and vehicles. That burden has an effect on retirees as well, as they struggle to help their own children manage their debt load. Many chose to co-sign for student loans, and because of inability of their child/children to pay, now struggle to make those payments themselves. NYSUT knows how stressful and complicated it can be to navigate student loans. so they have created a series of in-person workshops for NYSUT members, so you can get straight answers to your student loan questions either for yourself, or for a relative.

As you can see from the above chart created by credit.com, $67.8 billion of student loan debt is held by those 62 and over. This would have a huge impact on those entering retirement.

NYSUT workshops are led by Cambridge Credit Counseling and offer members the following:

- In-person presentation from a student loan counselor to help you better understand the various student loan repayments options with a focus on Teacher Loan Cancellation and Public Student Loan Forgiveness programs.

- Opportunity to schedule a free counseling session with a certified student loan counselor.

- Free access to a student loan portal that will quickly identify all of your options and provide a detailed action plan that you can then discuss with a certified student loan counselor.

- Q & A session following the presentation to address your specific questions.

To register for a workshop in Saratoga Springs on Tuesday, March 24th from 4:30 to 6:30 pm, go to the link listed below.